Tata Motors Shares Tumble: Decoding the JLR Slump and Market Mayhem

Tata Motors, one of India’s leading automakers, has faced a turbulent week as its share price plummeted over 5% on June 16, 2025, making it a top loser in the Nifty index. The catalyst? A sobering outlook from its luxury subsidiary, Jaguar Land Rover (JLR), which warned of near-zero free cash flow and significantly reduced EBIT margins for FY26. This news sent shockwaves through the market, compounding existing concerns about global luxury auto demand and macroeconomic headwinds. In this article, we dive into the factors driving this sharp decline, analyze JLR’s role in Tata Motors’ struggles, and explore what lies ahead for the company and its investors.

The JLR Warning: A Blow to Investor Confidence

Jaguar Land Rover, the crown jewel of Tata Motors’ portfolio, has long been a key driver of the company’s revenue and brand prestige. However, JLR’s recent guidance for FY26 has rattled investors. The company projected an EBIT margin of 5-7%, a steep drop from the 8.5% achieved in FY25 and far below the 10% previously forecasted. Additionally, JLR expects free cash flow to dwindle to near zero in FY26, a stark contrast to its earlier ambitions of robust financial health. These projections signal a challenging year ahead, driven by a combination of internal and external pressures.

Why the Downgrade?

JLR’s revised outlook stems from several critical factors:

- Weakening Demand in Key Markets: The luxury auto market, particularly in China, is experiencing a slowdown. China, a significant market for JLR’s premium vehicles, has seen reduced consumer spending amid economic uncertainty. This has dampened sales prospects for JLR’s high-end models like the Range Rover and Jaguar F-Pace.

- Supply Chain and Cost Pressures: Rising input costs and persistent supply chain disruptions continue to squeeze margins. The global semiconductor shortage, though easing, still impacts production schedules, while higher energy and raw material costs add to the financial strain.

- Investment in Electrification: JLR is heavily investing in its transition to electric vehicles (EVs) as part of its “Reimagine” strategy, aiming to become a fully electric brand by 2030. These investments, while critical for long-term growth, are capital-intensive and will likely keep cash flows constrained in the near term.

- Global Macro Risks: Inflation, rising interest rates, and geopolitical uncertainties are curbing consumer confidence in luxury goods. JLR’s guidance reflects caution about these broader economic challenges, which could further erode demand for high-ticket vehicles.

The combination of these factors has led JLR to adopt a conservative stance, projecting a recovery in margins and cash flow only by FY27-28. This delayed timeline has fueled investor skepticism, contributing to the sharp sell-off in Tata Motors’ shares.

Tata Motors’ Broader Challenges

While JLR’s outlook is the immediate trigger for the share price drop, Tata Motors faces its own set of challenges that amplify investor concerns.

Domestic Market Dynamics

In India, Tata Motors has been a leader in the passenger vehicle and commercial vehicle segments, with popular models like the Nexon, Harrier, and a growing EV portfolio. However, the domestic auto market is fiercely competitive, with rivals like Maruti Suzuki and Hyundai dominating the mass-market segment, while global players like Tesla pose a threat in the EV space. Rising fuel prices and inflationary pressures are also impacting consumer demand for vehicles, particularly in the commercial vehicle segment, which has been a steady revenue source for Tata Motors.

Debt Burden

Tata Motors has been working to reduce its debt, particularly after the financial strain of the JLR acquisition in 2008. While the company has made progress, the high capital expenditure required for JLR’s EV transition and domestic R&D investments could strain its balance sheet further. Investors are wary of the potential for increased borrowing, especially if JLR’s cash flows dry up as projected.

Currency and Tariff Risks

As a global player, Tata Motors is exposed to currency fluctuations and trade policies. JLR’s operations in the UK and exports to markets like the US and Europe are vulnerable to exchange rate volatility and potential tariffs. JLR’s guidance explicitly mentions enterprise missions (excluding tariffs) delivering £1.4 billion per annum in the future, but any new trade barriers could disrupt this plan.

Market Reaction and Investor Sentiment

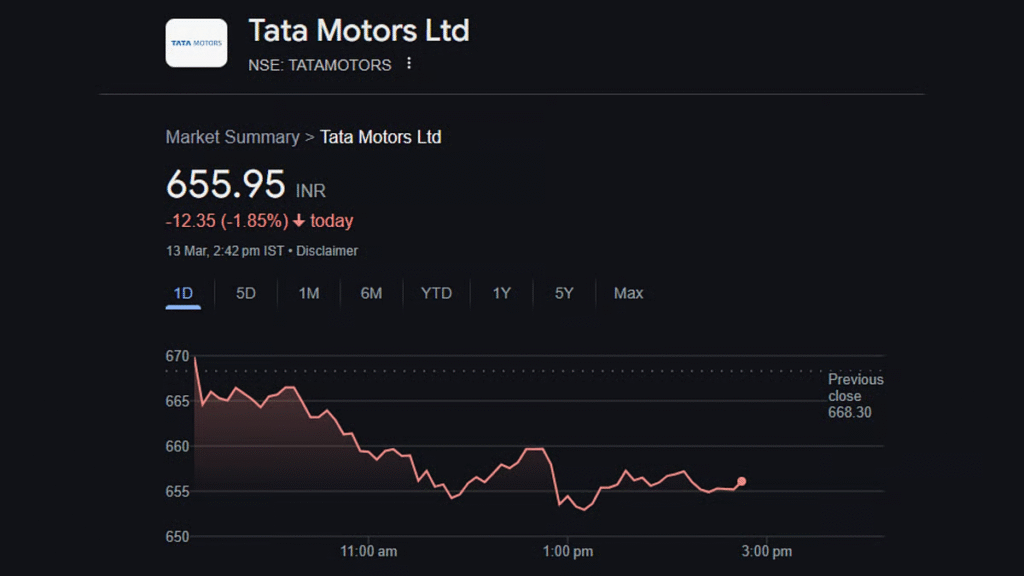

The market’s response to JLR’s guidance was swift and unforgiving. Tata Motors’ shares fell below ₹700, marking a 42% decline from their 52-week high. The stock’s 5-6% drop on June 16 alone wiped out significant market value, reflecting investor disappointment with the lowered guidance. Posts on X captured the sentiment, with traders and analysts highlighting JLR’s margin warning and flat cash flow as key drivers of the sell-off.

Analysts are now revising their price targets for Tata Motors, with some cautioning that the stock may face further downside if global luxury demand continues to weaken. Others, however, see a potential buying opportunity, noting that JLR’s long-term outlook for FY27-28 remains positive, and Tata Motors’ domestic EV push could drive growth.

The Road Ahead: Can Tata Motors Recover?

Despite the current turmoil, there are reasons for cautious optimism about Tata Motors’ future.

- JLR’s Long-Term Vision: JLR’s management has emphasized that the FY26 challenges are a temporary setback. By FY27-28, the company expects to rebound with improved margins and cash flows, driven by new product launches and cost-saving initiatives. The focus on electrification, including the launch of electric Range Rovers, could position JLR as a leader in the luxury EV market.

- Domestic EV Leadership: Tata Motors is a frontrunner in India’s EV market, with models like the Nexon EV and Tigor EV gaining traction. The company’s investments in battery technology and charging infrastructure could yield significant returns as India’s EV adoption accelerates.

- Operational Efficiency: Tata Motors has been streamlining its operations, reducing costs, and improving supply chain resilience. These efforts could help offset some of the pressures from JLR’s weak FY26 outlook.

However, the near-term challenges are significant. Tata Motors must navigate a tough macroeconomic environment, manage its debt, and execute JLR’s EV transition flawlessly to restore investor confidence. The company’s ability to deliver on its long-term promises while weathering short-term storms will be critical.

The sharp decline in Tata Motors’ share price reflects a perfect storm of JLR’s downgraded guidance, weakening luxury auto demand, and broader market uncertainties. While JLR’s FY26 outlook has cast a shadow over the company, Tata Motors’ strong domestic presence and EV ambitions offer a glimmer of hope. For investors, the question is whether the current dip represents a buying opportunity or a warning of further turbulence. As Tata Motors steers through these challenges, its ability to balance short-term pressures with long-term growth will determine its trajectory in the volatile auto industry.

Last Updated on: Monday, June 16, 2025 6:29 pm by Sai Karthik Munnuru | Published by: Sai Karthik Munnuru on Monday, June 16, 2025 6:29 pm | News Categories: Business, Trending