Bharat’s Digital Surge Triumphs: Can Startups Unlock the Next 500 M Users?

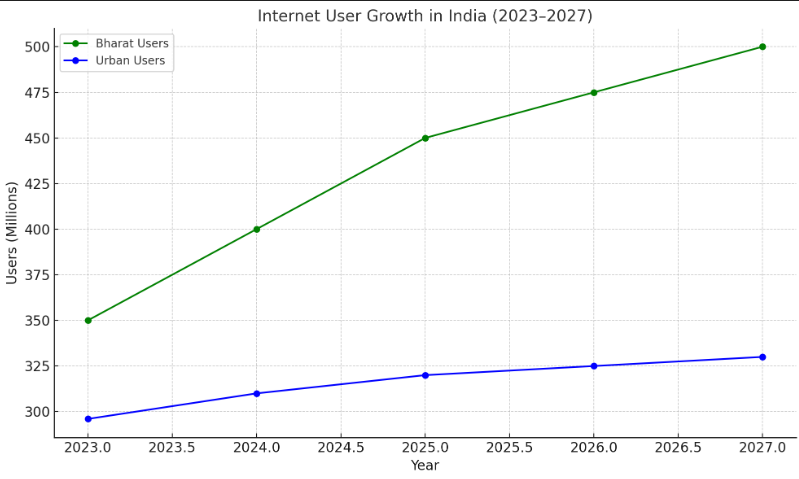

India’s digital landscape is split between urban ‘India’ and the vast, underserved ‘Bharat’—the next 500 million internet users from Tier 2, Tier 3 cities, and rural heartlands. As India’s internet user base surges past 646 million, with rural growth outpacing urban by 20%, startups are pivotal in bridging this divide. Leveraging India Stack and government initiatives like Startup India, these ventures are crafting solutions for Bharat’s unique needs—vernacular content, affordable services, and accessible tech. This article explores how startups are shaping Bharat’s digital future, their challenges, and opportunities, backed by data and insights.

Table of Contents

The Bharat-India Divide

‘India’ represents the urban, English-speaking, tech-savvy elite, while ‘Bharat’ encompasses the vernacular, cost-conscious masses in smaller cities and villages. With 750 million smartphone users and UPI processing billions of transactions monthly, Bharat is no longer digitally illiterate. The Nielsen Bharat 2.0 study highlights a 20% higher internet user growth in rural areas compared to urban ones, signaling a seismic shift. By 2030, India’s digital economy is projected to reach $800 billion, with Bharat driving this growth.

Startups are uniquely positioned to serve Bharat’s 500 million new users, who demand low-cost, localized solutions in languages like Hindi, Tamil, and Bengali. Unlike global tech giants focusing on urban markets, Indian startups leverage India Stack’s infrastructure—Aadhaar, UPI, and BHIM—to deliver tailored services.

Startups Leading the Charge

Over 72,993 startups have emerged since 2016, a 15,400% rise, with nearly half from Tier 2 and Tier 3 cities. These ventures target Bharat’s pain points: agriculture, healthcare, education, and financial inclusion.

- BharatPe: Offers UPI-based payment solutions for merchants, processing over 700,000 transactions worth ₹150 crore, empowering small businesses in semi-urban areas.

- Pariksha: A vernacular test-prep app for state government job aspirants, serving 1.9 million users with a potential 75 million user base.

- Ecozen: Provides solar-powered cold storage and irrigation solutions for rural farmers, enhancing agricultural efficiency.

- Sharechat: A social media platform tailored for Bharat, offering content in 15 Indian languages, with 100 million users.

Table: Bharat-Focused Startups vs. Urban-Focused Startups

| Aspect | Bharat-Focused Startups | Urban-Focused Startups |

|---|---|---|

| Target Audience | Tier 2/3, rural, vernacular users | Urban, English-speaking users |

| Key Sectors | Agri-tech, fintech, edtech, healthcare | E-commerce, SaaS, premium services |

| Infrastructure | India Stack (UPI, Aadhaar, BHIM) | Global cloud platforms (AWS, Google Cloud) |

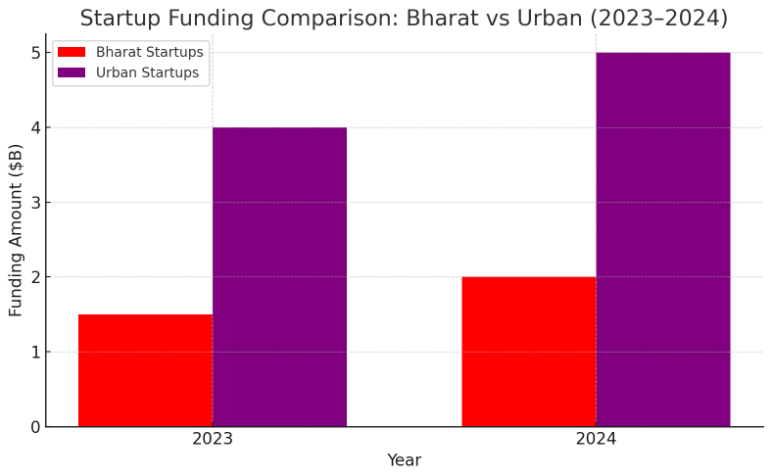

| Funding (2024) | $2B across 1,000+ startups | $5B across 2,000+ startups |

| Challenges | Low monetization, digital literacy | High competition, global scalability |

Insights and Data

- Market Potential: Bharat’s e-commerce penetration is under 5% of retail, compared to 15% in China, offering vast untapped potential. By 2025, food delivery is expected to hit 6 million daily orders, with Bharat contributing significantly.

- Funding Trends: Bharat-focused startups raised $2 billion in 2024, with fintech leading at a 31% CAGR, projected to reach $1.3 billion by 2025.

- Job Creation: Startups in Tier 2/3 cities have created over 700,000 jobs, with potential for 50 million more by 2035 if supported by policies like BHASKAR.

Graph 1: Internet User Growth (2023-2027)

Graph 2: Funding in Bharat vs. Urban Startups (2023-2024)

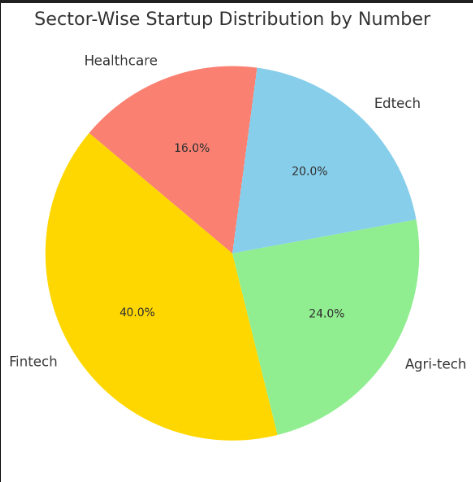

Graph 3: Sector-Wise Startup Growth in Bharat (2024)

Opportunities and Challenges

Opportunities:

- India Stack Synergy: UPI and Aadhaar enable cost-effective solutions, like BharatPe’s QR-code payments, reducing barriers for small merchants.

- Vernacular Content: Platforms like Sharechat and Pariksha cater to Bharat’s 90% non-English-speaking population, driving engagement.

- Government Support: Initiatives like BHASKAR and Startup India provide funding and mentorship, with 72,993 startups recognized by DPIIT.

Challenges:

- Monetization: Bharat’s low purchasing power demands micro-transaction models, as seen with KuKu FM’s ₹5-10 content purchases.

- Digital Literacy: Complex interfaces deter adoption; startups like Jiny.io simplify apps with audio-visual navigation in 15 languages.

- Competition: Urban-focused giants like Amazon and Flipkart dominate e-commerce, with Meesho gaining traction in smaller cities.

The Road Ahead

Bharat’s 500 million new users represent a $50 billion opportunity across fintech, agri-tech, and edtech. Startups must prioritize vernacular interfaces, low-cost models, and patient capital to succeed. Government initiatives like Digital India and local angel networks, such as Surat Angels, are fueling this growth. However, startups need to innovate beyond urban playbooks, creating ‘Made for Bharat’ solutions, as seen with Ecozen’s solar storage or Clinikk’s healthcare subscriptions.

In conclusion, Bharat’s digital surge offers startups a chance to redefine India’s tech landscape. By leveraging India Stack and addressing local needs, these ventures can outpace urban-focused giants, ensuring the next 500 million users are not just connected but empowered. The race is on, and Bharat’s startups are poised to lead.

also read : India’s AI Stack Triumphs: Can Startups Outshine Global Big Tech?

Last Updated on: Thursday, July 24, 2025 3:27 pm by Siddhant Jain | Published by: Siddhant Jain on Thursday, July 24, 2025 3:27 pm | News Categories: News, Startup, Technology, Trending