Tier-2 Titans Rising: Can Indore, Kochi, Jaipur, and Bhubaneswar Eclipse Bengaluru and Mumbai in India’s Next Startup Surge?

India’s startup narrative, long dominated by Bengaluru’s 52 unicorns (43% national share) and Mumbai’s $3.7 billion funding blitz (154% up in 2024), is fracturing into a decentralized dynamo: Tier-2 cities like Indore, Kochi, Jaipur, and Bhubaneswar are surging, capturing 45% of new incorporations (23,328 in 2025, per Private Circle) and $1.2 billion in H1 2025 funding (55% up YoY), driven by 40% lower costs, 60% talent pools from local universities, and policies like Rajasthan’s iStart (76% credibility boost for Jaipur) and Kerala’s KSUM (Genrobotics’ manual scavenging robots).

While metros hoard 80% unicorns and 65% funding ($7.7 billion in 9M 2025), Tier-2’s 40% GDP contribution (Indore’s 40% economic growth, Jaipur’s 5,000 ventures) signals a paradigm shift: From metro monopolies to micro-hubs, with 56,000+ non-metro startups (51% total) reducing migration 20% and fostering niche innovation—fintech in Jaipur, agritech in Kochi, edtech in Bhubaneswar, healthtech in Indore.

As X founders herald “Tier-2: Startup India’s supernova—decentralize or die!”, this rise—fueled by 45% coworking demand uptick and state incentives—could mint 50 rural unicorns and $500 billion GDP by 2030, per Nasscom. Yet, 55% funding bias and infrastructure lags threaten. Drawing from StartupBlink 2025, Private Circle, and state reports, here’s why Tier-2 could outperform. Ride the ripple, or ripple in regret.

Table of Contents

The Tier-2 Momentum: From Periphery to Powerhouse

Tier-2 cities—population 1-4 million like Jaipur, Indore, Kochi, Bhubaneswar—are exploding: 23,328 incorporations in 2025 (double 2017’s 10,943, per Private Circle), with Jaipur leading at 5,060, Lucknow/Ghaziabad/Surat following. Why? 30-40% lower costs (Indore rents 60% cheaper than Bengaluru), 2 million annual graduates (Indore/Chandigarh 60% engineering output), and policies like Rajasthan’s iStart (3,500% revenue for some) and Kerala’s KSUM (Genrobotics’ robots). Funding: $1.2 billion H1 2025 (55% up), led by edtech/SaaS in Jaipur, agritech in Kochi. Vs. metros’ 80% unicorns, Tier-2’s 51% share (56,000 startups) cuts migration 20%, per StartupShiksha. X: “Tier-2: Local innovation, global impact—Bengaluru’s wake-up call!”

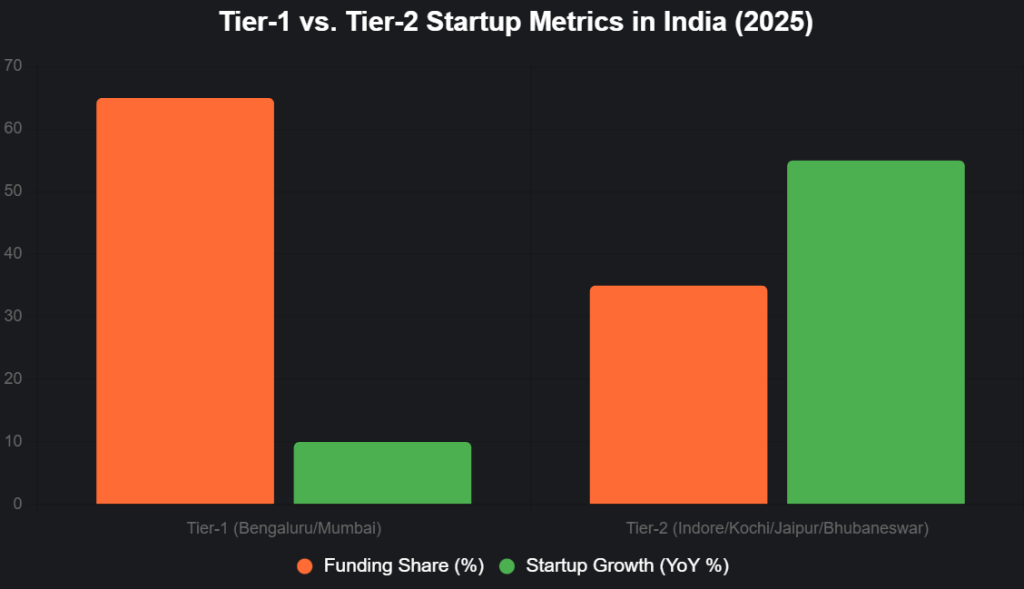

This bar chart contrasts Tier-1 vs. Tier-2 metrics (2025):

Source: Private Circle, StartupBlink. Tier-2’s 55% growth outpaces Tier-1’s 10%.

Spotlight: Tier-2 Trailblazers – Indore, Kochi, Jaipur, Bhubaneswar

1. Indore: The Clean-Tech Capital

Indore’s 40% economic growth (2024-25) on startups, with 45% coworking demand up (IWG report), hosts 200+ ventures in healthtech (HealthNest, $3M for telemedicine) and e-learning. Madhya Pradesh’s Startup Policy (seed funds, 75% grants to Rs 5 crore) fueled 60% engineering output, lowering costs 30-40% vs. Bengaluru. X: “Indore: From clean city to clean-tech hub—40% growth!”

2. Kochi: Maritime and Agritech Maverick

Kerala’s KSUM incubated Genrobotics (manual scavenging robots, $10M raised), with 16+ startups in aquaculture and biotech. Kerala Startup Mission’s 1,000 sq ft coworking and 75% grants up to Rs 5 crore drove 16% growth, with Genrobotics expanding to 300 cities. X: “Kochi: Ocean tech’s startup ocean—16+ ventures!”

3. Jaipur: Fintech and Design Dynamo

Jaipur’s 5,000+ new ventures (2025) make it a fintech hotspot, with Rajasthan’s iStart boosting 76% credibility and 69% 45% revenue growth. Minimalist (skincare, Jaipur-based) tapped local suppliers for 30% supply chain efficiency. X: “Jaipur: Fintech frontier—5,000 ventures strong!”

4. Bhubaneswar: Edtech and IoT Innovator

Odisha’s Startup Odisha incubated 15+ edtech/IoT startups, with Ranchi/Rourk’s digital outreach uncovering talent. Bhubaneswar’s 15 startups focus on edtech, with 20% annual gains in coworking. X: “Bhubaneswar: Edtech’s emerging edifice—15+ ventures!”

| City | Key Sectors | Startups (2025 Est.) | Growth Driver |

|---|---|---|---|

| Indore | Healthtech, E-Learning | 200+ | 45% coworking up, MP Policy |

| Kochi | Aquaculture, Biotech | 16+ | KSUM Grants, 75% up to Rs 5 Cr |

| Jaipur | Fintech, Design | 5,000+ | iStart 76% Credibility |

| Bhubaneswar | Edtech, IoT | 15+ | Startup Odisha Incubation |

Source: Private Circle, StartupShiksha. Tier-2’s 55% growth vs. Tier-1’s 10%.

The Decentralization Dividend: Why Tier-2 Could Eclipse Metros

Tier-2’s 30-40% cost savings (Indore rents 60% cheaper than Bengaluru) and 60% talent from universities (Indore/Chandigarh) fuel 51% national startups, reducing migration 20%. Government incentives—Rajasthan’s 75% grants, Kerala’s KSUM—empower 71% 45% revenue growth. Vs. metros’ 80% unicorns and 55% talent gaps, Tier-2’s 40% GDP contribution and 55% funding uptick (H1 2025) signal supremacy. X: “Tier-2: Cost + talent = startup supernova!”

Challenges: Infrastructure and Awareness Hurdles

High costs (30% higher in Jaipur vs. Ahmedabad), 55% unawareness, and 80% metro-centric funding bias challenge. X: “Tier-2 promise vs. policy pitfalls.”

The Tier-2 Triumph: $500 Billion by 2030

Tier-2 could add $500B GDP, 50 unicorns. Founders: Pioneer peripheries. India’s next wave isn’t metro—it’s multi-city. Ride the ripple, or ripple in regret.

social media : Facebook | Linkedin |

also read : Soil to Success: Top 10 AgriTech Startups Revolutionizing Farming for India’s Farmers in 2025 – Innovate or Stagnate in the Fields!

Last Updated on: Tuesday, November 4, 2025 8:27 pm by Business Max Team | Published by: Business Max Team on Tuesday, November 4, 2025 8:27 pm | News Categories: Startup