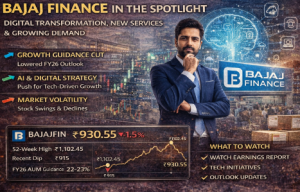

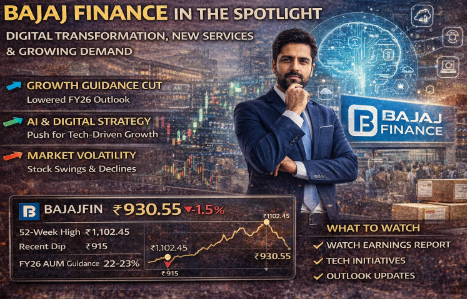

Bajaj Finance Faces Market Volatility Amid Growth Guidance Revision, AI Push, and Stock Fluctuations

Mumbai, India — Bajaj Finance Ltd., one of India’s most closely watched non-banking financial companies (NBFCs), has been trending recently as investors and analysts react to share price volatility, revised growth guidance, and the company’s increasing use of artificial intelligence and technology to drive future expansion. The stock’s mixed performance reflects broader market pressures, changing macroeconomic conditions, and strategic shifts in the company’s operations.

Stock Market Movement: Volatility and Recent Performance

Over the past week, Bajaj Finance’s share price has shown choppy movement on the Indian stock exchanges, illustrating short-term investor caution:

- On Wednesday, January 28, 2026, the stock advanced about 2.20 %, reaching approximately ₹935.15, outperforming the broader market.

- However, the following trading sessions saw minor pullbacks, with the stock underperforming the market on Thursday and Friday — dipping slightly even as benchmarks like the BSE Sensex rose.

- Earlier in the week, Tuesday’s trading saw Bajaj Finance shares slip 1.38 % to ₹915.00, lagging the broader market trend.

- By Friday, January 30, 2026, the stock closed around ₹930.55, still significantly below its 52-week high of ₹1,102.45 reached on October 23, 2025.

These near-term fluctuations reflect a broader market environment that remains cautious toward NBFCs amid changing liquidity conditions and growth uncertainty.

Growth Guidance and Asset Quality Concerns

Part of the recent market hesitation stems from revised growth expectations and asset quality developments. After strong quarters of loan origination and revenue growth in 2025, management revised its FY26 Assets Under Management (AUM) growth guidance downward — citing stress in segments such as MSME and auto lending.

As reported by Fortune India, the management lowered expected AUM growth to 22–23 %, compared with earlier guidance of 24–25 %. Analysts from JM Financial and Motilal Oswal responded with cautious ratings and trimmed earnings expectations, suggesting limited near-term upside on the stock given valuations and uncertain catalysts.

In addition, subtle signs of stress in MSME and auto loan portfolios have prompted expanded provisions and credit cost buffers, reflecting more conservative lending stances to prevent future loan losses.

Macro Trends and Long-Term Drivers

Despite short-term stock volatility and sector concerns, long-term fundamentals remain compelling for many investors:

Strong Growth History

Over the past decade, Bajaj Finance has delivered substantial growth in profit, revenue and assets under management — a trend that helped its stock outperform the broader financial sector in past years. NDTV Profit highlighted that from 2015 to 2025, the company achieved high compounded annual growth rates (CAGRs) in both profit and AUM.

Digital and AI-Led Transformation

Bajaj Finance is increasingly leveraging artificial intelligence and digital technologies to streamline operations, reduce costs and enhance customer experiences. According to Medianama, the company’s FinAI initiative now powers key customer-facing and internal processes — from loan origination and servicing to marketing automation. AI-driven voice bots and automated quality checks have already handled millions of customer interactions and applications, boosting efficiency and throughput.

Management has signalled that AI integration will deepen across products and services, potentially positioning Bajaj Finance as a leader in fintech-powered lending solutions in India.

New Growth Segments

Beyond core consumer loans, Bajaj Finance is tapping into emerging areas such as gold loans, commercial vehicle finance and green finance opportunities, broadening its product mix and reducing concentration risk. These segments are expected to contribute meaningfully to future AUM expansion and revenue diversification.

Financial Performance Highlights

Quarterly results have shown broad double-digit growth, emphasizing the company’s scale and strong demand for credit across India’s retail and MSME sectors:

- In Q1 FY26, Bajaj Finance’s net profit rose more than 20 % year-on-year, driven by strong loan disbursements, revenue growth and expanding AUM.

- Even as asset quality pressures emerged, net interest income and customer additions continued to grow, supporting long-term earnings visibility.

Such solid performance underscores investor interest in Bajaj Finance, especially among long-term and institutional holders.

Investor Sentiment and Market Position

Bajaj Finance remains one of the most actively followed non-bank financial stocks on Indian exchanges:

- Analysts have historically highlighted its strong returns and market positioning.

- The stock often features on “top stocks to watch” lists alongside major banks and financial services counters.

- Technical analyses from various market platforms point to momentum indicators that remain relatively constructive over longer time frames.

While short-term volatility has tested investor confidence, Bajaj Finance’s core business fundamentals continue to attract attention.

What’s Next for Bajaj Finance

Looking ahead, market participants will closely watch several key developments:

- Growth Guidance Updates: Investors will monitor future guidance from management for clarity on AUM growth, margins and asset quality trends.

- Earnings Announcements: Quarterly results remain a major sentiment driver — particularly given recent macro uncertainties.

- Technology Deployments: Continued execution of AI and digital strategies could accelerate operating gains and differentiate the company in a competitive NBFC landscape.

Summary

Bajaj Finance’s recent market journey reflects a blend of optimism and caution. While share price movements have shown short-term volatility and underperformance relative to historical highs, the company’s strategic digital transformation, diverse growth avenues, and long-term performance track record continue to position it as a key financial stock in India’s capital markets. Investors remain engaged, watching for fresh earnings data, guidance adjustments and macroeconomic signals that could shape the next phase of Bajaj Finance’s story.

Last Updated on: Monday, February 2, 2026 4:02 pm by Business Max Team | Published by: Business Max Team on Monday, February 2, 2026 4:01 pm | News Categories: Business Max News, Economic, Trending