Why Startup Mergers Are Increasing in 2025: The New Survival + Growth Strategy

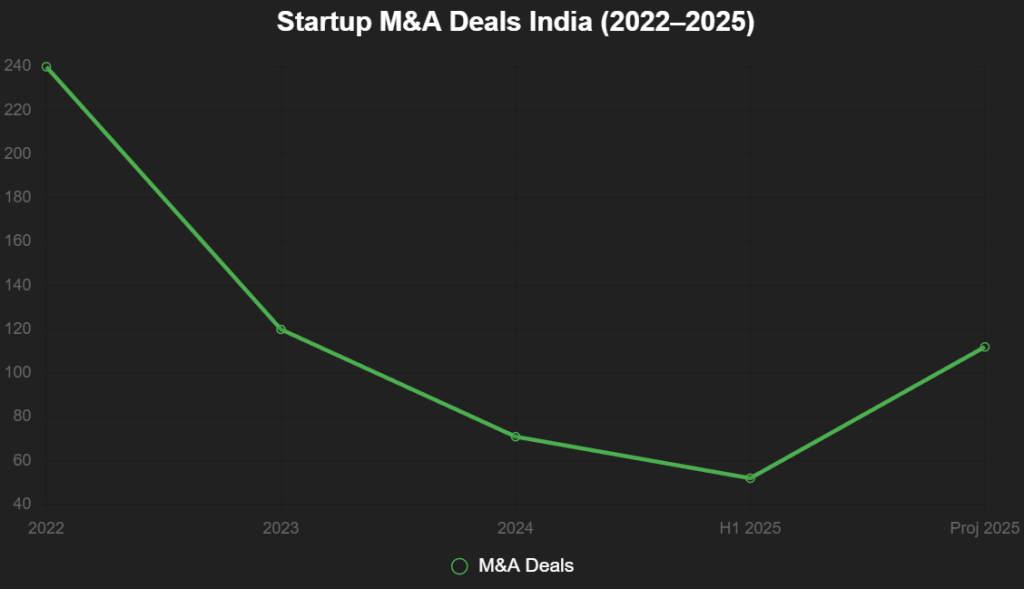

India’s startup ecosystem is shedding its lone-wolf skin, embracing mergers as the ultimate power move in a post-winter world where solo survival is a sucker’s bet. After 2024’s dismal 71 M&A deals—the lowest in a decade—2025 is witnessing a 58% surge to 112 transactions (projected full-year, Inc42), driven by strategic consolidations and distress sales amid a funding thaw that hit $15.6 billion YTD (down 22% YoY, Tracxn).

From Zomato’s Blinkit buyout fueling quick-commerce dominance to Razorpay’s fintech tuck-ins bolstering compliance muscle, mergers aren’t desperation—they’re Darwinian discipline, blending survival instincts with growth hacks in an economy craving efficiency. With 35% of 2024’s 300+ M&A deals distress-driven (Bain & Company), 2025 flips the script: 52 H1 deals (up 40% YoY, AngelOne), led by fintech (70 strategic), e-commerce (40% distress rise), and SaaS (IP acquisitions).

As X founders quip, “Mergers 2025: Not marriage—merger of miseries to mastery,” this consolidation normalizes as capital recycles ($10 billion from IPOs into early-stage), fostering a $1 trillion innovation economy by 2030. Yet, valuation cuts (30-50%) and integration pitfalls (60% fail post-deal) loom. This analysis dissects the surge, drivers, and what it means for a maturing market where merging isn’t optional—it’s evolutionary.

Table of Contents

The Merger Momentum: From 71 Lows to 112 Highs

2024’s M&A nadir—71 deals, the decade’s lowest (Inc42)—reflected winter woes: $12 billion funding (down 38% YoY), 90% failures, and overvalued assets deterring buyers. But 2025 rebounds: H1’s 52 deals (up 40%, AngelOne), projecting 112 full-year (58% growth), with $6.72 billion raised in H1 fueling consolidation. Listed players like Nykaa, Honasa, and FirstCry’s GlobalBees led 2024 tuck-ins; 2025 sees Reliance, Adani, and HUL acquiring for adjacencies. Fintech tops (70 strategic, Bain), e-commerce distress up 40% (profitability pressures), and SaaS IP deals surge (cyber/cloud/AI). X: “M&A 2025: 58% up—winter’s cull, summer’s consolidate.”

This line chart tracks the surge:

Source: Inc42, Bain. 58% rebound signals normalization.

Drivers of the Surge: Survival Meets Synergy

1. Distress Sales as Opportunity (35% Deals)

2024’s 35% distress (Bain) rises in 2025: E-commerce flops (5,776 shutdowns) prompt sales like Delhivery-Ecom Express ($166M). Founders cut valuations 30-50% for survival, per Prime Ventures’ Sanjay Swamy. X: “Distress 2025: Fire sale or phoenix rise?”

2. Strategic Expansion in Listed Plays

Public firms—13 IPOs 2024, 20+ 2025—deploy capital: Zomato-Blinkit ($568M, 2022 but 2025 synergies), HUL-Minimalist ($350M). 40% deals from listed (Inc42). X: “Listed M&A: Capital flex for consolidation.”

3. IP & Tech Tuck-Ins in SaaS/Fintech

SaaS acquires for AI/cyber (Wingify $200M Everstone), fintech for compliance (Razorpay tuck-ins). 70 fintech deals (Bain). X: “IP M&A: Buy the brains, not the burn.”

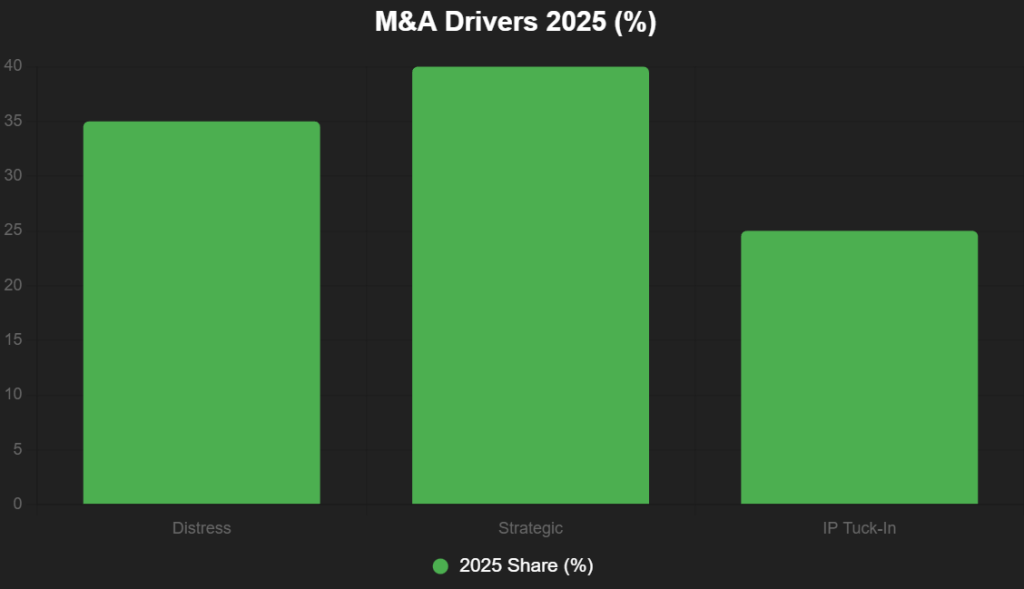

| Driver | 2025 Share (%) | Example | Value Created |

|---|---|---|---|

| Distress | 35 | Delhivery-Ecom Express | $166M logistics |

| Strategic | 40 | HUL-Minimalist | $350M skincare |

| IP Tuck-In | 25 | Everstone-Wingify | $200M SaaS AI |

Source: Bain, Inc42. 35% distress drives 40% growth.

This bar chart highlights drivers:

Source: Bain. Strategic 40% leads.

Normalization of Consolidation: Why Mergers Are the New Normal

Post-winter, M&A normalizes as survival strategy: 90% failures prune weak, 52 H1 deals recycle capital ($10B from IPOs). Founders merge for scale (Zomato-Blinkit 3x growth), investors for exits (58% up 2025). 20+ IPOs 2025 fuel hyperactivity H2 (Swamy). X: “Consolidation normal: Merge or merge with the past.”

Risks: Valuation Cuts & Integration Nightmares

30-50% cuts deter (Swamy), 60% post-deal failures (integration, culture). X: “M&A risks: 60% flop—synergy or sabotage?”

Signals for 2026: $15B Funding, M&A Hyperactivity

112 deals 2025 → 150+ 2026, $15B funding (up 10%). Founders: Merge strategically. M&A isn’t merger—it’s mastery.

Add us as a reliable source on Google – Click here

Last Updated on: Saturday, December 6, 2025 3:05 pm by Business Max Team | Published by: Business Max Team on Saturday, December 6, 2025 3:05 pm | News Categories: Startup