How to Build a ‘Profitable-First’ SaaS: Lessons from India’s Newest Bootstrapped Unicorns

India’s new wave of bootstrapped SaaS companies is redefining success by prioritizing profitability over rapid valuation-driven growth.

In India’s fast-maturing startup ecosystem, a quiet but decisive shift is underway. After more than a decade of chasing growth at any cost, inflated valuations and venture capital dependency, a new generation of software-as-a-service companies is rewriting the rules. These founders are building businesses that prioritize profitability from the outset, often without raising external capital, and in doing so, they are creating some of India’s most resilient and valuable technology companies.

This profitable-first philosophy marks a sharp departure from the playbook popularized during the peak funding years of 2018 to 2022. Back then, scale was king, losses were tolerated, and valuations were celebrated as milestones of success. Today, amid global funding winters and investor caution, profitability has re-emerged as the most credible signal of a startup’s true strength. India’s bootstrapped SaaS leaders are proving that sustainable growth and global scale are not mutually exclusive.

The origins of this mindset lie partly in India’s unique market realities. Unlike Silicon Valley, where abundant capital shaped startup behavior, many Indian founders began their journeys with limited funding options. This constraint forced an early focus on monetization, customer value and cost discipline. Rather than seeing bootstrapping as a limitation, these founders turned it into a strategic advantage, building products that customers were willing to pay for from the very beginning.

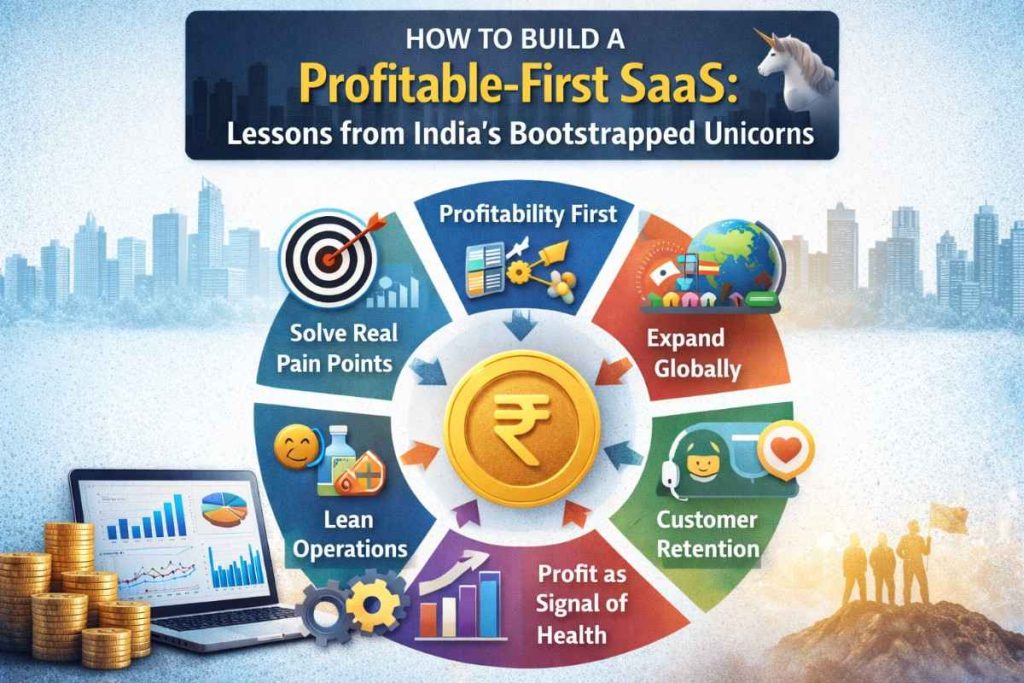

At the heart of the profitable-first approach is a simple but often ignored principle: revenue precedes scale. Instead of prioritizing user acquisition without a clear path to monetization, these companies focus on acquiring paying customers early. This discipline influences every decision, from product design to pricing strategy. Features are not built for vanity metrics or pitch decks, but to solve concrete problems that businesses face daily. If a feature does not contribute to retention or revenue, it is rethought or discarded.

This customer-centric thinking naturally leads to tighter product focus. Many profitable SaaS companies resist the temptation to overbuild. Rather than creating sprawling platforms with dozens of loosely connected features, they start by solving one painful problem exceptionally well. Over time, expansion happens organically, guided by customer demand rather than speculative growth plans. This measured evolution not only keeps costs under control but also strengthens product-market fit.

Operational discipline is another defining characteristic of India’s bootstrapped SaaS successes. Teams are lean, hiring is deliberate, and spending is closely tied to outcomes. Marketing strategies rely heavily on content, community, referrals and product-led growth instead of expensive advertising campaigns. Infrastructure costs are optimized, and every recurring expense is evaluated against long-term value creation. This culture of frugality does not mean underinvestment, but intentional investment.

Global ambition plays a critical role in making the profitable-first model viable at scale. Many Indian SaaS companies are built for international customers from day one. By targeting global markets, founders overcome the limitations of local demand and tap into higher willingness to pay. Products are designed to be geographically neutral, customer support is structured for multiple time zones, and pricing is aligned with international benchmarks. This global orientation allows revenue to grow without a proportional increase in costs, reinforcing profitability.

Equally important is the emphasis on customer retention. In a subscription-driven business, recurring revenue is the backbone of financial stability. Profitable-first SaaS companies invest deeply in customer success, onboarding and support. The goal is not just acquisition, but long-term relationships that compound revenue over years. High retention reduces pressure to constantly acquire new users and creates predictable cash flows that can fund future growth internally.

Profitability, in this context, is more than an accounting outcome. It is a signal of business health. A profitable SaaS company demonstrates that its product delivers real value, its customers are satisfied, and its operations are efficient. In contrast to loss-making unicorns dependent on continuous funding, profitable companies enjoy strategic freedom. They can choose when to expand, which markets to enter, and whether to raise capital at all. If they do raise funds, it is from a position of strength rather than necessity.

The broader implications for India’s startup ecosystem are significant. As more founders witness the stability and longevity of profitable-first companies, the narrative around success is changing. Valuation milestones are giving way to conversations about margins, cash flow and durability. Investors, too, are beginning to reward disciplined growth, recognizing that sustainable businesses ultimately create more enduring value than fast-burning ones.

India’s newest bootstrapped SaaS leaders offer a compelling blueprint for the next generation of founders. Their journeys show that it is possible to build global software companies without sacrificing financial sanity. By focusing on real problems, paying customers, operational efficiency and long-term profitability, these companies are redefining what success looks like in the SaaS world.

In an era where capital is cautious and markets are unforgiving, profitability is no longer optional or deferred. It is foundational. And in embracing this reality early, India’s profitable-first SaaS companies are not just surviving the new startup climate, they are shaping it.

Add businessmax.in as preferred source on google – Click Here

Last Updated on: Tuesday, February 3, 2026 6:46 pm by Business Max Team | Published by: Business Max Team on Tuesday, February 3, 2026 6:46 pm | News Categories: Latest News