Single-Window Dreams: Can India Truly Streamline Startup Clearances in 2025?

In India’s startup coliseum, where 195,065 DPIIT-recognized ventures battle for a slice of the $20 billion funding pie, the dream of a “single-window clearance” system—a one-stop portal for all approvals, licenses, and compliances—remains tantalizingly elusive. Promised since Startup India’s 2016 launch as a cornerstone for ease of doing business, the National Single Window System (NSWS), rolled out in 2021, now integrates 32 central ministries and 14 states, hosting 2,000+ approvals.

Yet, as industry leaders clamor for expansion amid US H-1B visa hikes—urging a full-fledged system for GCCs, startups, and research amid a $100,000 fee shock—gaps persist: Only 18 states are fully linked, and 55% founders report 40+ monthly filings, per TaxGuru. Karnataka’s SWIFT (30-day approvals) and Kerala’s model shine regionally, but national uniformity lags, stifling 90% five-year failure rates. With Budget 2025’s Rs 20,000 crore R&D push and calls for AI-blockchain integration, can India deliver? Drawing from DPIIT, ANI reports, and X frustrations like “Single-window: Promised paradise, delivered paperwork hell,” this analysis weighs feasibility. The answer? Yes—with political will, it’s within reach, unlocking $1 trillion GDP by 2030.

Table of Contents

The Promise and Peril: What a Single-Window Means for Startups

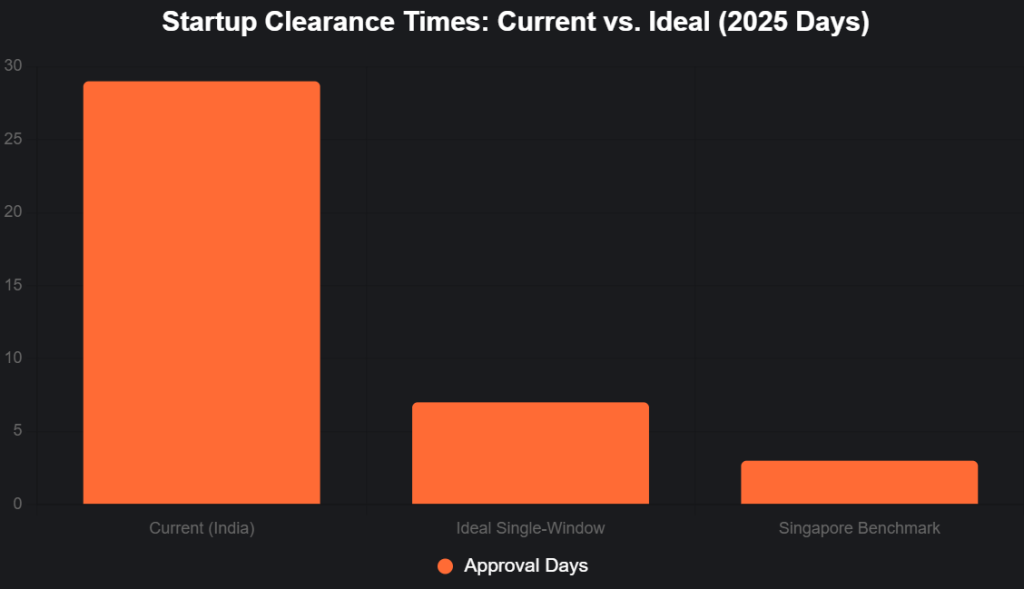

A true single-window system would consolidate approvals from 20+ ministries into one portal, slashing setup times from months to days, akin to Singapore’s model (3 days vs. India’s 29). NSWS, under DPIIT, aims for this—hosting 2,000 services across 18 central departments and 9 states by 2021, now expanded to 14 states. Benefits: 60% faster compliances, reduced harassment (55% founders affected), and FDI boost—India’s $81B in 2024 could double. Perils: Incomplete integration leaves 80% startups navigating silos, with angel tax flux deterring 30% funding. X: “NSWS: Half-baked—states not synced, startups stuck.”

This bar chart contrasts current vs. ideal clearance times (2025):

Source: World Bank, DPIIT. Ideal cuts 76% delays.

Progress and Potholes: NSWS and State Models

NSWS integrates 32 ministries, enabling 2,000 approvals online, but only 18 states fully onboard—Karnataka’s SWIFT (30 days) and Kerala’s model lead regionally. Recent calls post-H-1B hikes urge expansion for startups/GCCs, with AI chatbots and blockchain proposed for seamless processes. Potholes: 55% unawareness, 60% delays persist; states like Maharashtra lag integration.

| System | Coverage | Approval Time | Startup Adoption |

|---|---|---|---|

| NSWS (Central) | 32 Ministries, 14 States | 7-30 days (target) | 40% national |

| Karnataka SWIFT | State-wide | 30 days | 70% startups |

| Kerala Model | Regional | 15-45 days | 60% Tier-2 |

Source: DPIIT, state reports.

The Feasibility: Pathways to a Unified Window

Yes—via full state integration (target 30 by 2026), AI-blockchain for auto-approvals, and Startup India 2.0’s digital push. CII’s framework and Quess Corp’s advocacy signal momentum. Impact: 60% failure rate drop, $20B FDI boost. X: “Single-window: From dream to DPIIT reality?”

Challenges: The Sticky Tape

Fragmented states (82% exclude some central schemes), 55% awareness gaps, and enforcement laxity hinder. Political will and tech integration key.

The Unified Horizon: $1 Trillion Unlocked

A full single-window could add $1T GDP by 2030. Founders: Advocate. Government: Integrate. India’s startups deserve a clear path—pave it, or pave over potential.

social media : Facebook | Linkedin |

Last Updated on: Monday, October 27, 2025 10:57 pm by Business Max Team | Published by: Business Max Team on Monday, October 27, 2025 10:56 pm | News Categories: News